ResMed’s Tariff Exemption and Strategic Growth in the U.S.

In a dynamic global trade environment, ResMed, a leading medical technology company specializing in sleep apnea and respiratory care devices, has secured a significant advantage. The U.S. Customs and Border Protection (CBP) has confirmed that ResMed’s devices, primarily manufactured in Sydney, Australia, and Singapore, will remain exempt from recent tariffs under the Nairobi Protocol. This exemption shields ResMed from the financial burdens of a 10% general tariff on imported goods and a steep 145% tariff on products from China, as outlined in April 2025 trade policies. Below, we explore the implications of this exemption, ResMed’s strategic response, and its broader impact on the medical technology industry.

Understanding the Nairobi Protocol Exemption

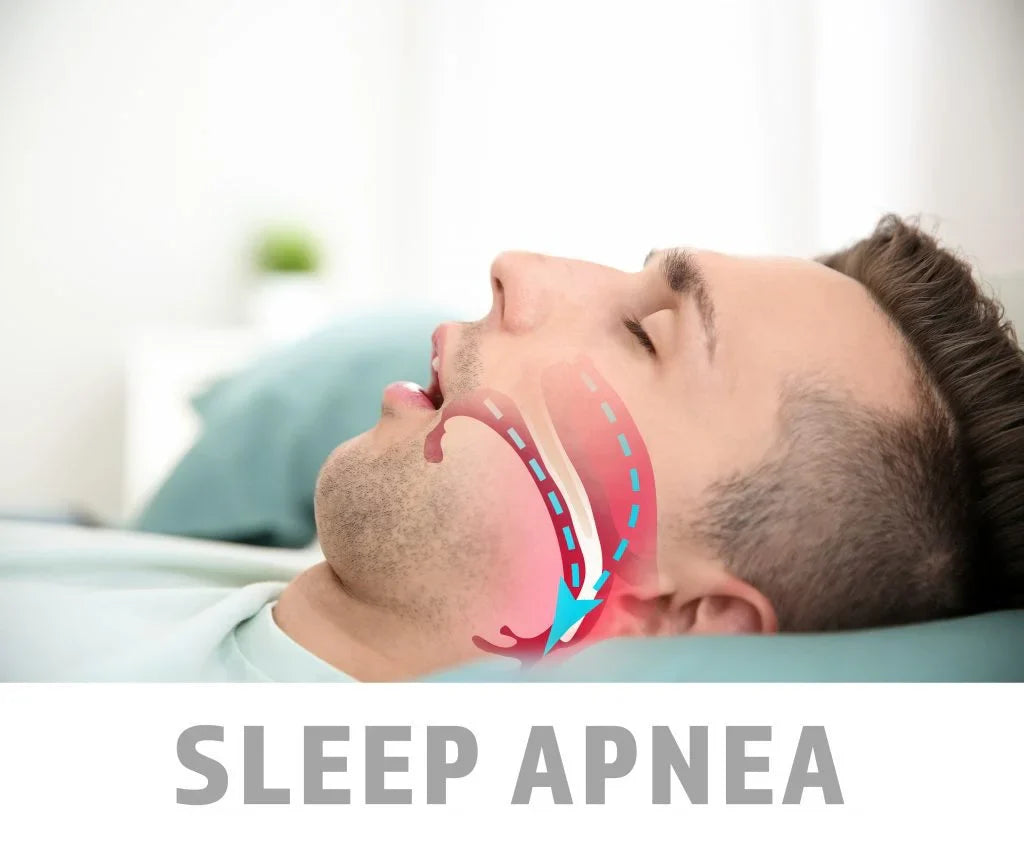

The Nairobi Protocol, an extension of the Florence Agreement, facilitates duty-free treatment for products designed or adapted for individuals with disabilities, including those with chronic respiratory conditions like obstructive sleep apnea (OSA). ResMed’s continuous positive airway pressure (CPAP) devices and related accessories fall under this category, ensuring they remain exempt from tariffs that could otherwise increase costs for patients and healthcare providers.

Mick Farrell, ResMed’s Chairman and CEO, emphasized the company’s favorable position during a recent earnings call for the third quarter of fiscal year 2025. “Our products have been subject to global tariff relief for decades,” Farrell noted, highlighting that federal authorities reaffirmed this exemption in April 2025. This stability is particularly significant given the volatile tariff landscape, which includes heightened duties on imports from countries like China, a key manufacturing hub for some of ResMed’s competitors.

The exemption provides ResMed with a competitive edge, especially against rivals sourcing from “hot-band” countries facing triple-digit tariffs. Farrell declined to speculate on competitors’ tariff statuses, particularly those manufacturing in China or Mexico, but suggested that ResMed’s operations in trade-friendly nations like Australia and Singapore bolster its advantageous position. This strategic manufacturing footprint minimizes exposure to punitive tariffs while aligning with U.S. trade preferences.

Navigating the Tariff Landscape

The current U.S. tariff regime, shaped by Executive Order 14257 (April 2, 2025), imposes a 10% additional duty on most imported goods effective April 5, 2025, with country-specific rates, such as 145% on Chinese imports, effective April 9, 2025. These measures aim to address trade imbalances but have raised concerns about increased costs for consumers and businesses. For the medical technology sector, tariffs could exacerbate affordability challenges for critical devices like CPAP machines, which are essential for managing sleep apnea—a condition affecting over 54 million Americans.

ResMed’s exemption under the Nairobi Protocol mitigates these risks, ensuring that its devices remain accessible without significant price hikes. This is particularly crucial as healthcare costs continue to strain patients and providers. By avoiding tariffs, ResMed can maintain competitive pricing, reinforcing its market leadership in the global sleep health sector, valued at approximately $10 billion annually.

Advocating for Industry-Wide Relief

Beyond securing its own exemption, ResMed is championing broader tariff relief for the medical technology industry. As a board member and future chairman of AdvaMed, a leading medical technology trade association, Farrell is advocating for a “zero for zero” tariff policy for med-tech products. This initiative seeks duty-free treatment for all medical devices, arguing that such exemptions are humanitarian necessities rather than competitive advantages.

“I don’t need to be a competitor with a short-term advantage—I’ll beat them, anyway,” Farrell stated confidently. “We’ll fight to do those as the right thing on a humanitarian basis.” This stance reflects ResMed’s commitment to patient access and affordability, aligning with global health priorities to ensure life-saving devices remain within reach. Farrell’s leadership at AdvaMed positions ResMed to influence trade policy, potentially benefiting the entire industry.

Strategic Investments in U.S. Manufacturing

While the tariff exemption provides immediate financial relief, ResMed is not resting on its laurels. The company is doubling down on its U.S. manufacturing capabilities with a new $30 million high-tech facility in Calabasas, California, set to open in June 2025. This facility will expand ResMed’s domestic manufacturing footprint, complementing its existing plant in Chatsworth, California. The Calabasas hub will focus on research and development (R&D) for motor technology and the production of silicone mask cushions, critical components of CPAP systems.

“This facility is designed to scale over the coming years with multiple mask molding cells and more growth, as mask manufacturing increases to meet growing demand,” Farrell explained. By localizing production, ResMed aims to streamline supply chains, reduce reliance on international manufacturing, and enhance efficiency in serving its largest market—the United States, which accounts for over 60% of its $1.3 billion third-quarter 2025 revenue.

This investment also aligns with broader industry trends toward onshoring manufacturing to mitigate geopolitical and trade risks. The Calabasas facility will create jobs, boost local economies, and position ResMed to respond swiftly to rising demand for sleep health solutions, driven by increased awareness and the growing prevalence of sleep apnea.

Competitive and Financial Outlook

ResMed’s tariff exemption and U.S. manufacturing expansion come at a time of robust financial performance. The company reported third-quarter 2025 revenues of $1.3 billion, an 8% increase year-over-year, surpassing forecasts of $1.29 billion. Its gross margin of 59.02% reflects operational efficiency, bolstered by the tariff exemption, which minimizes cost pressures.

Analysts remain optimistic about ResMed’s trajectory. Mizuho Securities maintained an Outperform rating on ResMed’s stock, adjusting its price target to $250 from $265, citing the company’s tariff advantage and resilience against potential market disruptions, such as the rise of GLP-1 medications for weight loss, which could reduce sleep apnea prevalence. Oppenheimer also praised ResMed’s strong financials and market positioning, though it noted long-term challenges from GLP-1 drugs if approved for OSA treatment.

Posts on X reflect similar sentiment, with users highlighting ResMed’s competitive edge and tariff exemption as key drivers of its $49 billion valuation. One post noted, “Aussie medical tech giant ResMed wins tariff exemption from Trump’s global trade levies,” underscoring the significance of its duty-free status.

Broader Implications for the Med-Tech Industry

ResMed’s success in securing a tariff exemption underscores the importance of the Nairobi Protocol in protecting access to medical devices. However, the uneven application of tariffs could create disparities within the industry. Competitors manufacturing in high-tariff countries like China face significant cost pressures, potentially leading to higher prices or supply chain shifts. Farrell’s cryptic remark about competitors—“You’ve got to ask them and see where they’re at”—hints at a fragmented landscape where ResMed’s exemption provides a distinct advantage.

The broader med-tech industry could benefit from Farrell’s advocacy for tariff exemptions. A “zero for zero” policy would level the playing field, ensuring that all patients, regardless of device brand, have access to affordable care. This is particularly critical for CPAP devices, which require ongoing supplies like masks and filters, adding to patient costs. Industry-wide exemptions could also encourage innovation by reducing financial barriers to market entry.

Conclusion

ResMed’s tariff exemption under the Nairobi Protocol, coupled with its strategic investments in U.S. manufacturing, positions the company as a leader in the evolving medical technology landscape. By shielding its CPAP devices from tariffs, ResMed ensures affordability for patients while maintaining financial stability. Its advocacy for industry-wide tariff relief and expansion of domestic production further demonstrate a forward-thinking approach to global trade challenges.

As the tariff landscape continues to shift, ResMed’s ability to navigate these complexities while prioritizing patient care sets a benchmark for the industry. The Calabasas facility, set to open in June 2025, will enhance ResMed’s capacity to meet growing demand, reinforcing its role as a global leader in sleep health. For patients, providers, and investors, ResMed’s story is one of resilience, innovation, and a commitment to improving lives—one breath at a time.

Sources

-

U.S. Customs and Border Protection, CSMS #64724565, April 11, 2025.

-

HME News, “Resmed says that U.S. Customs and Border Protection has confirmed its devices will continue to be exempt,” April 25, 2025.

-

Investing.com, “Mizuho cuts ResMed stock price target to $250 from $265,” April 24, 2025.

-

Posts on X, April 24–25, 2025.

Leave a comment

This site is protected by hCaptcha and the hCaptcha Privacy Policy and Terms of Service apply.